• Citi analysts forecast the global earning growth to be 9.7% in an aging bull market; emphasize not the start of a downturn and see opportunities in the volatility

• Citi analysts highlight the 2019 investment trends to remain overweight equities in Emerging Markets, particularly Asia and Europe-ex UK, while sectors to watch are technology, health and materials; suggest to diversify portfolio by investing in multi-asset portfolios.

• Citibank is partnering with “Fidelity International” to launch 5 mutual funds providing the world class investment solutions for clients to diversify their portfolios.

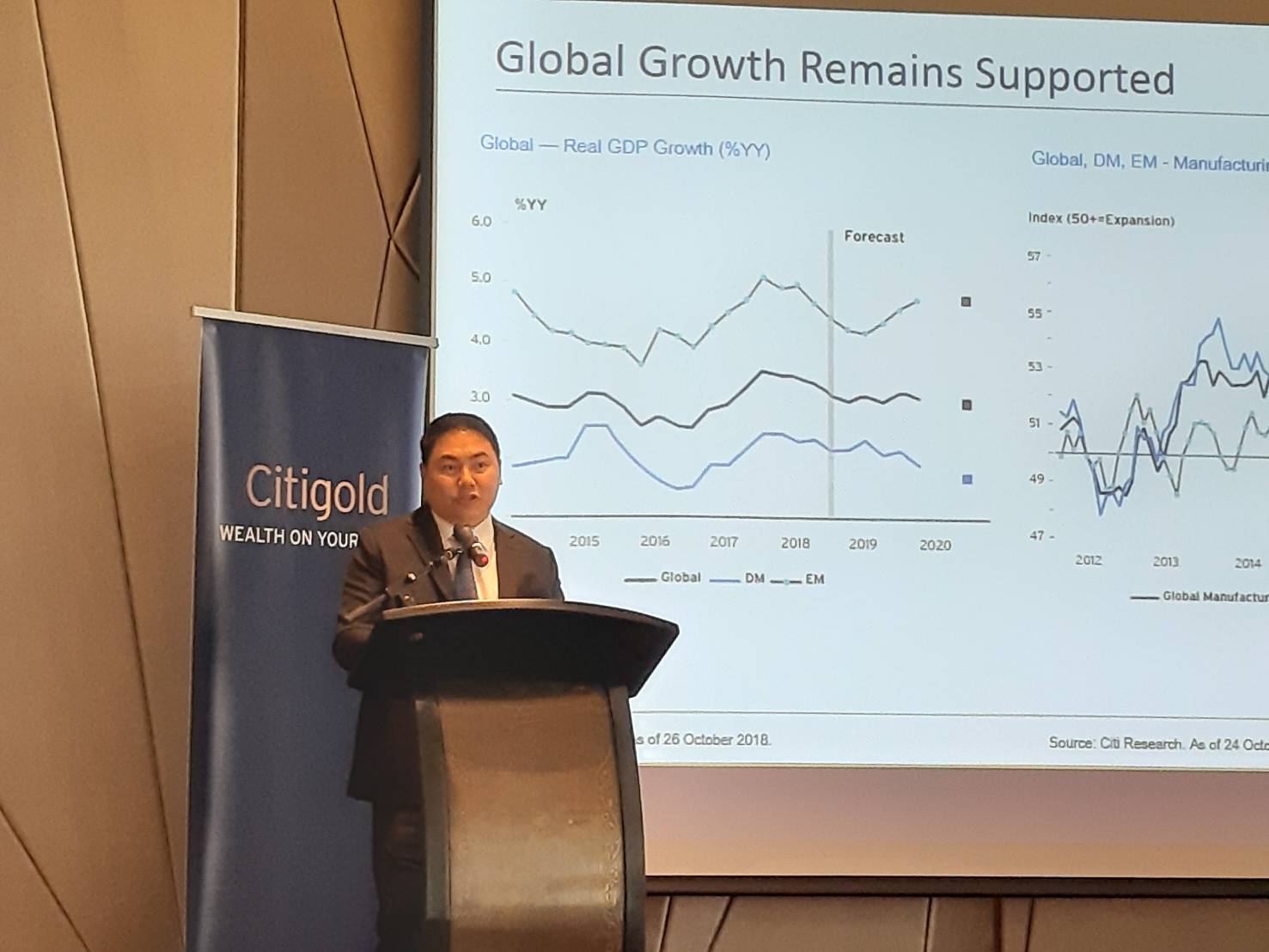

Bangkok, January 30, 2019 – Citibank Thailand expect the global economy growth of 3.1%, slightly slower than 2018, re global events with fluctuations throughout the year.

Citi analysts are expecting global earnings per share (EPS) to grow by 9.7% in 2019 and forecast bull market has not ended even it is in the late cycle, with an emphasis that this is not the start of a downturn. They remain overweight equities and prefer Emerging Markets (EM), particularly Asia that targeted 4.5% economic growth in 2019, and Europe-ex UK. Citi analysts believe it is still too early to turn defensive and prefer Technology, Healthcare, and Materials. Citi recommend diversified high-quality portfolios can provide buffer in times of volatility.

In addition, Citi analysts point out uncertain factors that investors should consider such as as political uncertainties in each region, trade wars and geopolitical risks, interest policy global currencies, etc.

In this regard, Citi Bank Thailand recently held “2019 Annual Outlook” to reveal economic and investment theme in 2019 and launch of new partnership with “Fidelity International” at the Siam Kempinski Hotel, Bangkok. For more information, please contact Citi Bank Thailand or visit www.citibank.co.th.

Mr. Don Charnsupharindr, Director, Retail Banking Head, Citibank Thailand, stated that the overall global economy in 2019 was expected to slightly slow down, from 2018, to 3.1% as a result of global events and economic factors which have been unstable during the past year. Downside risks to growth include monetary policy divergence across markets, rising of protectionism and trade tensions, heightened political risks and China or US slowdown. Emerging markets trend is to grow by 4.5% in 2019 and 4.6% in 2020, while developed markets are forecasted to grow, by 2.0% and 1.7%, respectively.

Mr. Don further added that in terms of global currency, Citi expected US Dollar weakness as a result of the fading impact of President Trump’s late cycle fiscal stimulus. Thai Baht is likely to strengthen within the frame of 32.70 - 33.00 baht per US dollar.

Citi expected the United States’ Federal Reserve (FED) to hike policy rate twice more in 2019. The European Central Bank (ECB) and Bank of Japan (BoJ) maintain their interest rates under strict monetary policy.

Furthermore, risks to the global growth outlook that investors should consider are political uncertainty in each region, current global trade tensions which remain elevated with markets focused more on geopolitical headlines. As a result, despite a still favorable global economic outlook, it is predicted that the global growth is likely to slow down.

Citi analysts suggest that investors remain diversified their portfolios by investing in various asset classes. Citi recommend alternative investment and diversified multi-asset class portfolios and remain overweight equities and underweight bonds. Within equities, Citi prefers Emerging Markets (EM), particularly Asia, and Europe-ex UK. Citi analysts believe it is still too early to turn defensive and prefer Technology and Materials, while Healthcare could provide shelter from volatility. In terms of bonds, Citi remains constructive on US Investment Grade (IG) bonds, preferring opportunities in short and intermediate term maturities. US High Yields (HY) bonds are also favored especially as default rates continue to decline amidst a favorable US economic outlook.

"Citi analysts still hold a positive view towards equities in the technology, materials and healthcare sectors. The technology market trades are at 20% premium to the global benchmark. Despite the volatility in 2018, consensus expects EPS growth of 11% in 2019. Citi analysts remain bullish on Materials as they believe the market is not fully valuing the medium to long-term upside that the sector can deliver. The global Materials sector EPS could grow by a further 5.5% in 2019. The sector trades at about a 45% discount to the market, compared to a 25% historical average discount. In addition, an aging world population and technologies that unlock demand could drive earnings growth in Healthcare, with US and EU large-caps offering 8% and 6% five-year EPS from 2019. The sector trades at a 15% premium compared to the rest of the market."

Citibank, along with "Fidelity International", a world class investment management partner, has launched 5 highlighted Funds to expand investment horizon across various geographies and asset classes.

Mr. Wildon Goh, Wholesale Director, South East Asia, Fidelity International elaborated that the selected mutual funds are Fidelity’s flagship and word-class offerings where the fund performances are competitive against peers. The various fund strategies also align with Citibank’s Annual Outlook for 2019.

1. Fidelity Funds- Global Dividend Fund invests in income producing company shares globally. The fund uses a bottom-up approach to invest in companies that offer a healthy yield underpinned by a growing level of income, as well as the potential for capital growth.

2. Fidelity Funds Emerging Markets Fund invests in company shares in EM countries in areas experiencing rapid economic growth including Latin America, South East Asia, Africa, Eastern Europe (including Russia) and the Middle East.

3. Fidelity Funds Asian High Yield invests in high yield corporate bonds of Asian domiciled issuers, diversified across a number of countries and sectors.

4. Fidelity Funds China Yield Fund invests primarily in high-yielding, sub-investment grade or non-rated securities of issuers that have their majority of their activity in the Greater China region (including China, Hong Kong, Taiwan, and Macau).

5. Fidelity Funds Global Technology Fund invests in the shares of companies throughout the world that will provide, or benefit significantly from, technological advances and improvements in relation to products, processes or services.

Moreover, Citibank also have wealth planning innovations for Citigold customers, such as "Total Wealth Advisor" that gives customers the overview of investment portfolio and risk indicator index, which helps ensure that the investment is properly distributed and managed by a professional fund manager with global experience, Mr. Don concluded.

In this regard, Citi Bank Thailand recently held “2019 Annual Outlook” to reveal economic and investment theme in 2019 and launch of new partnership with “Fidelity International” at the Siam Kempinski Hotel, Bangkok. For more information, please contact Citi Bank Thailand or visit www.citibank.co.th.

.jpg)

No comments:

Post a Comment